Borrowing money for business or personal reasons requires careful evaluation of interest rates and lender terms, and overall financial implications. Prime rates play an important influence on loan and credit cost. Understanding the prime rate can help when deciding whether to apply for credit cards or business loans.

Many lenders base their loan rates on the loan prime rate, which serves as a basis to calculate interest. PrimeRates simplifies lending by offering personalized loan offers.

What is the prime rate? And how is it able to work?

The prime rate refers the interest rate that banks charge their most creditworthy customers, which are typically large companies. Federal Reserve’s federal funds rate determines the prime rate. The prime rate is adjusted when the Federal Reserve changes interest rates.

For borrowers, this rate is crucial because it acts as the foundation for most credit products. Most lenders will add a margin to prime rates dependent on the creditworthiness an applicant. Borrowers with good credit ratings get rates that are close to prime rates. For those with poor credit histories may get higher rates in order to compensate for a higher risk.

How Prime Rates Affect Business loans

The ability to secure a custom business loan is crucial due to a myriad of reasons, including the financing of expansions, purchasing inventory, and regulating cash flow. However the price of borrowing is directly connected to the prime rate, which makes it essential to know their effects prior to signing an investment.

Lower Prime Rates imply Lower Borrowing Costs – When the prime rate is low, business loans become less expensive. They can access funds at a lesser rate of interest, which makes the perfect moment to invest in expansion of business.

Higher Prime Rates Increase Loan Expenses – A rising loan prime rate results in higher borrowing costs. The monthly payments will increase in a way that can affect a business’s cash flow and overall profitability. Financial stability can be maintained through planning ahead to anticipate changes in interest rates.

Credit Scores Influence Loan Terms. While the prime rate is an important benchmark to decide on the terms of loans, it is contingent on a borrower’s credit profile. Firms with strong financial histories get better rates, and those with less favorable credit scores may need to look at alternative financing options.

Prequalification Can Ensure Better Loan Offers – Instead of applying blindly and being rejected, borrowers can profit from prequalification tools that connect them with lenders based on financial standing. This method provides an understanding of potential rates before committing to an application for a loan.

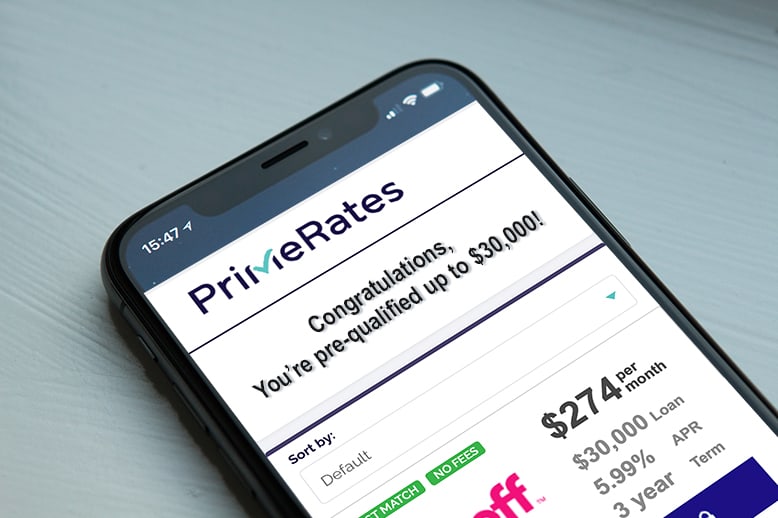

Getting the right loan is easy with PrimeRates

It can take a lot of time to compare loan offers and learn about the different terms used in lending. PrimeRates provides a platform that the borrowers can look over their customized business loans without impacting their credit scores.

Pre-qualification Process Simple – Applicants are able to receive customized loan options based upon their financial needs by submitting basic information.

Transparent Comparisons of Rates Instead of guessing which rates are in effect, borrowers may see actual offers.

Secure and reliable loan options – Lender partnership agreements provide access to attractive rates and flexible terms.

Final Review of Prime Rates and Business Loans

Knowing the prime rates before applying for a loan is crucial, whether it’s for expansion or to lower expenses or improve credit profiles. A lower loan rate can translate into lower cost borrowing, while a greater prime rate can impact financial planning.

Instead of being left not knowing the truth, borrowers have the option of taking advantage of platforms that offer the most precise information regarding their loans’ eligibility and interest rates. Explore personalized business loan options via transparent lenders, ensuring access to financing solutions aligned with financial goals.