Expanding an online business into new markets is a daunting task, especially when navigating the complexities of VAT registration, VAT filings as well as extended producer responsibility (EPR). If you have the right tools and with support it can be made more simple. Staxxer is a complete system that is a one stop store for all of your VAT and EPR needs. It ensures smooth and efficient operations in Europe for sellers selling online.

The difficulties of VAT compliance

Compliance of the Value Added Tax (VAT), is among the most essential aspects of running an online company in Europe. Each country has its own VAT laws. To ensure compliance, you need to pay focus on every single detail. Online retailers must be registered for VAT in each country where they sell and file regular returns for VAT, and guarantee a precise estimation of VAT due. This can be a long process that is also prone to errors, removing important resources away from other tasks of business.

Staxxer: Your one-stop shop for VAT Compliance

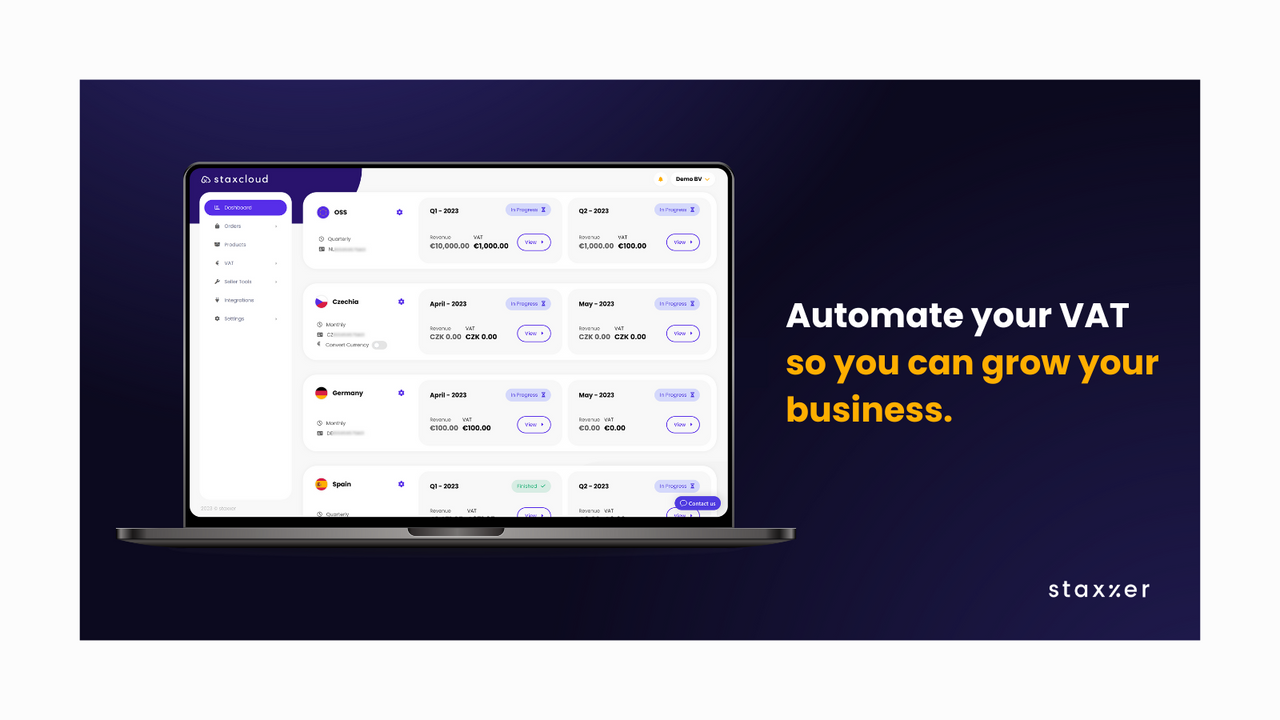

Staxxer simplifies VAT compliance by providing an all-in-one solution for VAT registration and VAT filings. Through automation of these processes, Staxxer allows online sellers to concentrate on expansion and growth with no burden on administrative tasks. Here’s how Staxxer simplifies VAT compliance:

Automated VAT registration: In order to expand into a different country you need to register for VAT in the particular country. Staxxer simplifies the process of registration to ensure conformity with local laws and regulations.

Effective VAT Files: Businesses operating in Europe are required to regularly file VAT tax returns on a monthly basis. Staxxer simplifies the process of VAT filing to ensure timely and accurate submissions. The platform connects all sales channels, consolidating information to calculate VAT owed in every country to the cent.

Staxxer’s VAT Management solution includes everything from handling VAT declarations through to the calculation of VAT. The end-to-end management allows businesses to be compliant without having to dedicate significant resources and time for VAT-related work.

Role of extended producer liability (EPR).

Extended Producer Responsibility (EPR) is a green policy approach that holds producers responsible for the entire lifecycle of their products which includes disposal and recycling. That means that online retailers have to comply with the regulations pertaining to electronic wastes, as well as other product-specific waste streams.

Staxxer’s EPR Solutions

Staxxer offers its expertise in this field, too. Here’s how Staxxer helps businesses manage their EPR obligations:

Automated EPR Compliance Staxxer’s platform is able to automate the reporting and management of waste. Businesses can be in compliance with environmental regulations without having to add any additional administrative tasks.

EPR requires detailed reports on the kinds of waste and their amounts. Staxxer helps simplify this process by the collection of data and the creation of accurate reports.

Sustainable Business Practices. Businesses can increase their sustainability by controlling EPR requirements efficiently. Staxxer’s solutions allow businesses to reduce their environmental impact, promoting sustainable production and disposal practices.

Why Entrepreneurs Choose Staxxer

Entrepreneurs and businesses that sell online select Staxxer because of its broad and automated solutions to simplify VAT and EPR compliance. These are just a few of the most important benefits:

Automating VAT filings, EPR compliance and other administrative tasks can save companies time and let them focus on expansion and growth. Staxxer’s solutions help reduce the need for manual data entry and administrative tasks.

Staxxer’s platform makes accurate calculations to minimize the risk of mistakes and penalties. The accuracy of the software is essential to maintain compliance and avoid costly mistakes.

Easy to Use Easy to Use: Staxxer’s user-friendly interface as well as its seamless integration with a variety of sales channels help firms to manage their EPR and VAT obligations. The intuitive design of the platform simplifies complicated procedures which makes compliance easy.

Staxxer’s VAT and EPR compliance allows firms to operate with peace of mind, knowing that all regulations are met. Entrepreneurs who wish to expand without worrying about regulations will find this security invaluable.

The conclusion of the article is:

Staxxer is a one-stop-shop for businesses seeking to streamline their compliance with VAT and EPR. Through automation of VAT registration, VAT filings, and EPR filings, Staxxer allows businesses to focus on growth and expansion. Platform’s comprehensive solution ensures accurate calculation prompt filing and long-lasting processes. It’s the perfect solution for entrepreneurs seeking to expand their business without borders. Staxxer provides a range of options to make ensuring compliance simple.